Being a homeowner is a dream that many people share. The idea that you could be the owner of your own property is exciting and something that a lot of us strive for at some point in life. However, with owning a house comes the variety of upkeep responsibilities that you’ll have every month. These expenses can be daunting and even problematic, especially if you’ve lost a job or have had a new bill added to the dozens that you already owe. Saving on these everyday expenses is essential for reducing financial stress while living there.

Your Monthly Mortgage

The mortgage that you pay is essentially a loan from the lender that allows you to live there. You technically do not fully own the property until this loan is paid off, since the home can go into foreclosure if you begin to default on payments. The key to stop overpaying for your mortgage is to compare rates. You can compare quotes to find a lender that offers affordable rates and considerably generous repayment terms. If you already have a mortgage with a specific lender, you may want to consider refinancing as a way to lower those monthly payments.

Insurance

Homeowners insurance is essential for protecting your property and assets in the event of an emergency. Many of these policies protect against fires, floods and even burglaries. Home insurance can be quite pricey, but you can avoid overspending because quotes are available from online brokers. In addition, you can make necessary upgrades to your house that lower its liability, which might include using fencing if you have a dog or pool, or it could involve removing a fireplace and installing a more economical and fire-safe heating system.

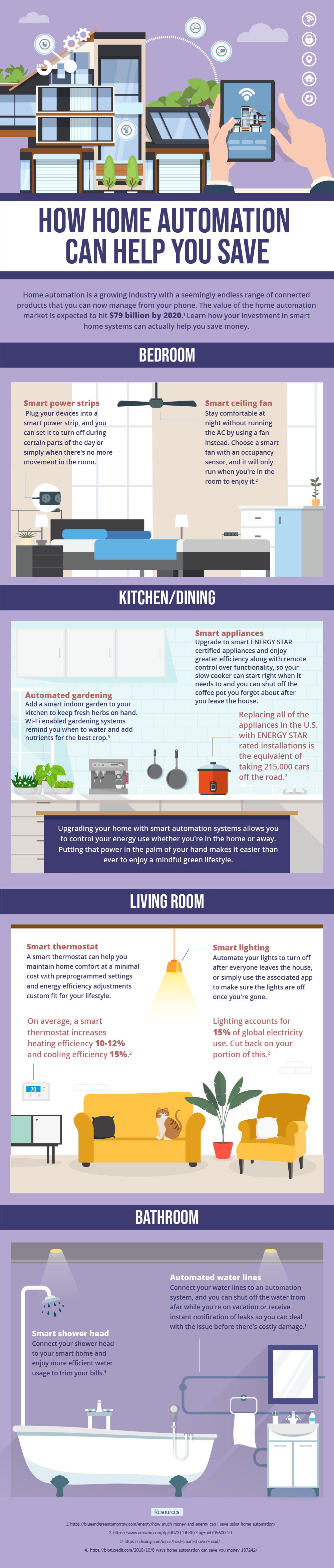

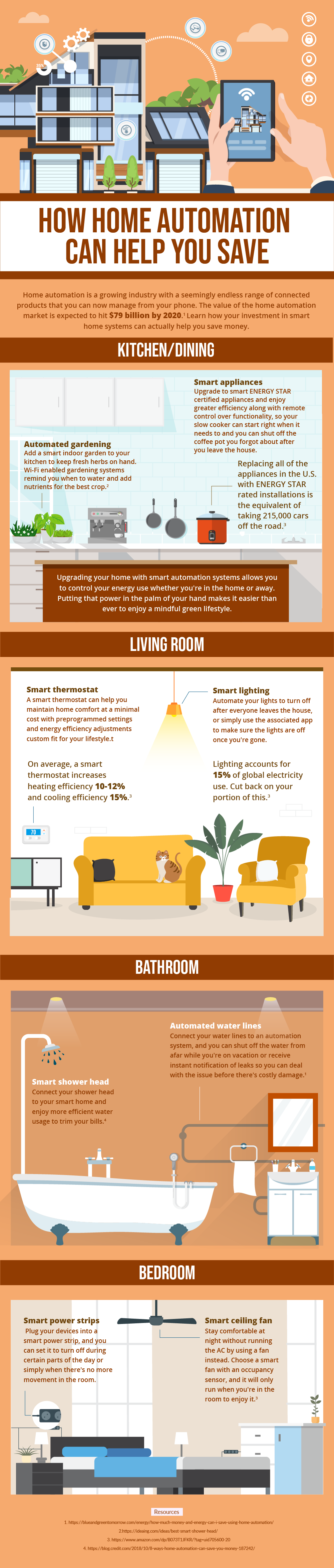

Utilities

Utilities often include things like electric, fuel for heating systems, internet and cable. In most cases, these utilities are an absolute necessity in order to live comfortably within the home with your family. The best way for you to lower the costs of these services is to simply do research to see which companies offer the best prices. For example, your cable and internet service can be bundled together to reduce overall costs and fees. The fuel that you’re using to power the heating system can come from a cheaper company rather than the one you’ve been using for years. Most areas have multiple service providers available, so it just takes a bit of research to find the one that’s right for you.

Maintenance Costs

Maintaining your home is very important, as it helps to prevent major repairs from needing to be done. Maintenance can include things like lawn care, yearly roof inspections and trash pickup. While all of these services are needed to keep the property in good working condition, they can also run into a lot of money. As with your utilities, comparing different companies and receiving quotes from several of them can be beneficial in cutting costs.

Repairs

Repair work may be needed from time to time if something breaks down either inside or outside of the house. Your septic system needs to be replaced or you have to get a new roof installed because the current one is leaking. A great way to avoid the shock of these repair costs is to set up an emergency fund specific to your property. If something breaks down and needs to either be replaced or repaired, you won’t need to take out loans or max out credit cards just to fix things.